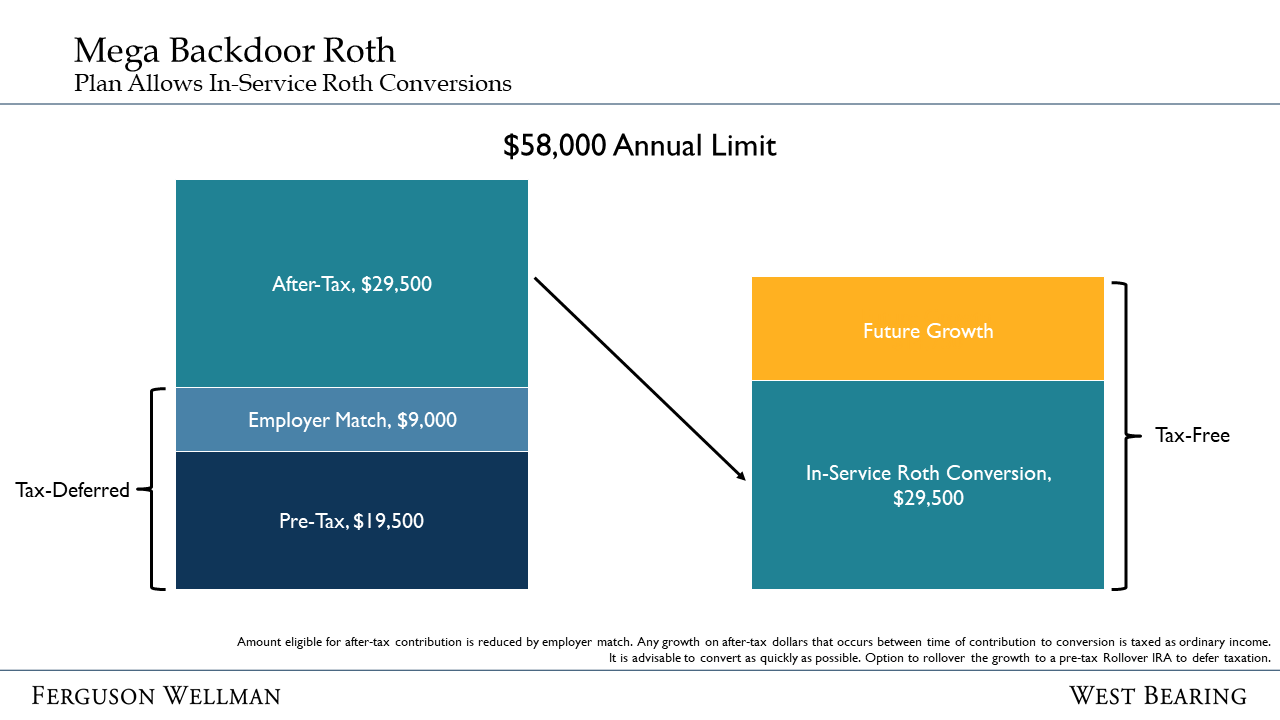

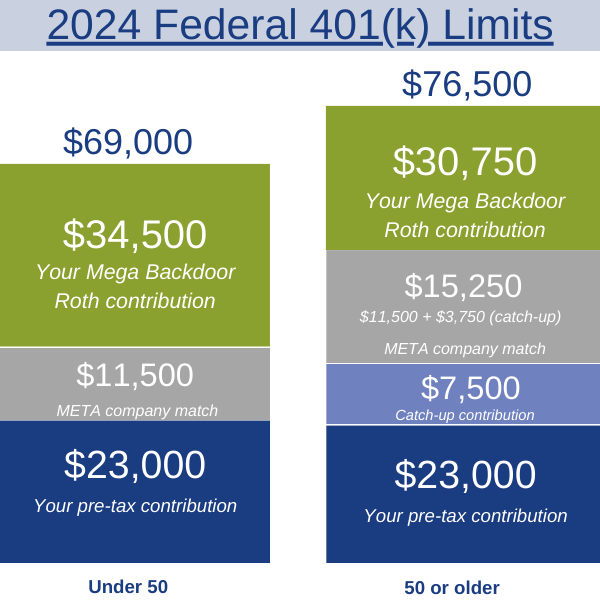

Mega Backdoor Roth Limit 2024. But there's another limit, which is $69,000 in 2024 (or $76,500 for people 50 and older). As of 2024, mega backdoor roth conversions are still allowed.

One of the primary pitfalls of the mega backdoor roth conversion is misunderstanding or exceeding contribution limits. You can’t contribute more than 100% of your salary,.

Mega Backdoor Roth Limit 2024 Cris Michal, In 2024, the mega backdoor roth strategy allows 401(k) contributions up to $69,000 for those under age 50 and $76,500 for people 50+. But there's another limit, which is $69,000 in 2024 (or $76,500 for people 50 and older).

Mega Backdoor Roth Conversions Too Good to be True?, You can’t contribute more than 100% of your salary,. Income limit for a full roth ira contribution.

Backdoor Roth Limits 2024 Flora Jewelle, The annual contribution limit is $7,000 for 2024, plus an extra $1,000 if you’re age 50 or older. The roth ira limit is subject to an income.

Mega Backdoor Roth Limit For 2024 + How It Works Playbook, In 2021 and 2022, you could contribute up to $6,000 ($7,000 if 50 or over) per year. But there's another limit, which is $69,000 in 2024 (or $76,500 for people 50 and older).

Mega Backdoor Roth 2024 Limit Bessy Charita, If your employer matched any of your yearly contributions, your mega. Income limit for a full roth ira contribution.

Backdoor Roth Contribution Limits 2024 Lois Sianna, In 2021 and 2022, you could contribute up to $6,000 ($7,000 if 50 or over) per year. This includes the regular 401 (k).

What is the Meta Mega Backdoor Roth? Avier Wealth Advisors, In 2024, the total dollars allowable into a 401 (k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older. In 2021 and 2022, you could contribute up to $6,000 ($7,000 if 50 or over) per year.

Amazon Mega Backdoor Roth Sophos Wealth Management, I'm seeking expert advice and guidance regarding my 2024 investment plan, specifically the mega backdoor roth section. The resulting maximum mega backdoor roth ira contribution for 2024 is $46,000, up from $43,500 in 2023 if your employer makes no 401(k) contributions on.

2024 META 401(k) & Mega Backdoor Roth Save Thousands Towards, As of 2024, mega backdoor roth conversions are still allowed. For 2024, the total contribution limit.

2024 Mega Backdoor Roth (69k Into Retirement) StepByStep How To, The resulting maximum mega backdoor roth ira contribution for 2024 is $46,000, up from $43,500 in 2023 if your employer makes no 401(k) contributions on. *pending changes from secure act 2.0 which allows for employer contributions to the roth.